Forge Place

Register your interest

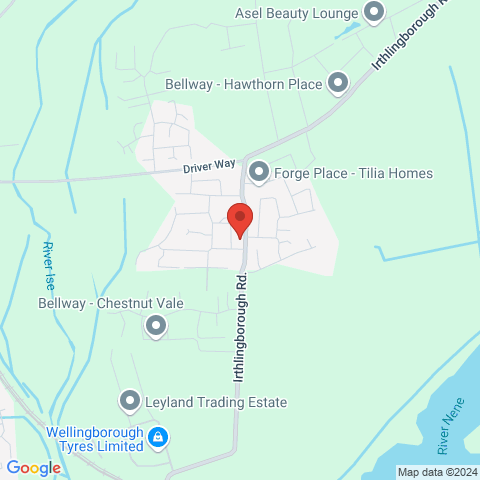

Forge Place

Click to filter

|

3 Bedrooms Terraced house |

|---|---|

| Property Number | 60 |

| Availability | FOR SALE |

| Advertised Share | 60% |

| Full Market Price | £299,950 |

| Deposit From | £8,999 |

| Monthly Rent | £275 |

| Monthly Mortgage Cost | £995 |

| Monthly Service Charge | £0 |

| Estimated Monthly Cost | £1,270 |

| Bedrooms | 3 |

| Bathrooms | |

| Number Of Floors | 3 |

| Tenure | Leasehold |

|

|

Forge Place

Overview

OPEN HOUSE EVENT

- Saturday 6th September between 10am - 5pm

- View our last remaining homes

- Financial advice is available

- Drinks will be served all day and food will be available from 11am - 4pm

- Chat with us about our current offers and moving schemes.

Please call if you would like to attend, as booking is recommended

Final homes remaining - call now - don't miss out!

UP TO £20,997CASHBACK* AVAILABLE! CALL FOR MORE DETAILS. T&CS APPLY

Forge Place offers a stylish range of new homes in Wellingborough, Northamptonshire. Designed with first-time buyers and families in mind, these energy-efficient homes feature modern layouts, high-quality finishes, and a range of sizes to suit every lifestyle.

- Choose from 81 thoughtfully designedhouses for sale in Wellingborough.

- Ideal for first time buyers and families seeking modern living.

- Built with energy-efficiency in mind, Force Place features spacious layouts, stylish interiors and exceptional comfort.

- A new pub, shop and primary school are planned within the development, meaning even more convenience on your doorstep.

Key Features

- Upgraded kitchen with appliances

- Flooring throughout

- Turfed rear garden

- Upgraded bathroom

Brochures

Site Plan

FAQs

Shared ownership is a government-backed scheme, designed to make stepping onto the property ladder more affordable. You buy a portion of a home normally with a mortgage and a deposit, and pay a low-cost rent on the rest.

The eligibility criteria for Shared Ownership is simple; as long as you don't currently own, or won't own another property when you move in to a new home, you're likely to qualify.

Your annual household income (that's both yours and your partners' if buying together) can't exceed £80,000 (or £90,000 in London) and you'll need to have savings to cover purchasing costs such as solicitors fees and your mortgage deposit.

There's no fixed minimum income; you just need to be able to afford to buy the home and the monthly costs - this will be established via an affordability.

No - the scheme is designed to help people buy a suitably sized home that they cannot afford to buy otherwise. That typically means first time buyers, but if you've owned a home before and are selling, perhaps due to a divorce or needing to buy a bigger home, and cannot afford to buy, you might be eligible for Shared Ownership.

All Shared Ownership properties will have a service charge. If there is not one showing on the listing it will be in the Key Information Document that is available with the listing.

In shared ownership, a service charge is a monthly or periodic payment made by the shared owner towards the cost of maintaining and managing the communal areas of the building or estate. It's separate from the rent paid on the share of the property not owned.

Affordability Calculator

Disclaimer

The figures and estimates shown in this calculator should not be relied on as confirmation of affordability and should only be used as an indicative guide to monthly costs. The monthly rental cost is based on 2.75% on the retained equity (subject to change please ask your sales agent). This will usually increase by the annual rate of RPI. The monthly mortgage cost is based on a Variable Rate Mortgage at 4.75% over a 30-year repayment loan. Other costs will apply such as service charge. Sage Homes is not authorised or regulated by the Financial Conduct Authority to provide financial advice. You should always seek advice and recommendations from an independent financial advisor regarding mortgage products, affordability, interest rates, repayment methods and terms and conditions. You should also seek independent legal advice. Your home may be repossessed if you do not keep up payments on a mortgage or any other loan secured against it.