Lockside Wharf

Register your interest

Click to filter

|

2 Bedrooms Semi-detached house |

|---|---|

| Property Number | 83 |

| Availability | FOR SALE |

| Advertised Share | 50% |

| Full Market Price | £300,000 |

| Deposit From | £7,500 |

| Monthly Rent | £344 |

| Monthly Mortgage Cost | £744 |

| Monthly Service Charge | £49 |

| Estimated Monthly Cost | £1,137 |

| Bedrooms | 2 |

| Bathrooms | 1 |

| Number Of Floors | 1 |

| Tenure | Leasehold |

|

|

Lockside Wharf

Overview

Plot 83 unexpectedly back on the market - Enquire today!

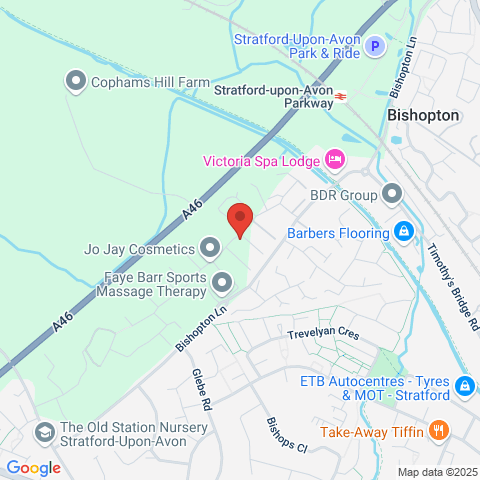

Situated in a semi-rural location in the hamlet of Bishopton, Stratford-upon-Avon, Lockside Wharf offers a stunning development brought to you by Taylor Wimpey.

The Lockside Wharf development provides a large amount of open space with paths linking throughout, featuring a trim trail and natural play area. There is a Community Orchard, areas of woodland and wildflower planting, creating a wildlife friendly landscaped setting. A bus stop will provide access to Stratford town centre.

Travel Times

- 33 mins From Stratford-Upon-Avon to Leamington Spa

- 2hr 2 mins From Stratford-Upon-Avon to London Marylebone

- 5 mins Local Primary School

- 9 mins Stratford-Upon-Avon Parkway Station

- 5 mins Large supermarket superstore

- 5 mins Maybird Shopping Centre

- 20 mins Royal Leamington Spa

Key Features

- NHBC Warranty

- Allocated parking

- Downstairs WC

- Good storage

- Separate kitchen

- Service charge applicable

FAQs

Shared ownership is a government-backed scheme, designed to make stepping onto the property ladder more affordable. You buy a portion of a home normally with a mortgage and a deposit, and pay a low-cost rent on the rest.

The eligibility criteria for Shared Ownership is simple; as long as you don't currently own, or won't own another property when you move in to a new home, you're likely to qualify.

Your annual household income (that's both yours and your partners' if buying together) can't exceed £80,000 (or £90,000 in London) and you'll need to have savings to cover purchasing costs such as solicitors fees and your mortgage deposit.

There's no fixed minimum income; you just need to be able to afford to buy the home and the monthly costs - this will be established via an affordability.

No - the scheme is designed to help people buy a suitably sized home that they cannot afford to buy otherwise. That typically means first time buyers, but if you've owned a home before and are selling, perhaps due to a divorce or needing to buy a bigger home, and cannot afford to buy, you might be eligible for Shared Ownership.

All Shared Ownership properties will have a service charge. If there is not one showing on the listing it will be in the Key Information Document that is available with the listing.

In shared ownership, a service charge is a monthly or periodic payment made by the shared owner towards the cost of maintaining and managing the communal areas of the building or estate. It's separate from the rent paid on the share of the property not owned.

Disclaimer

Please note these photos are for information purposes only and may not represent a true likeness for the homes being sold. Some of the images may have been taken from another development of similar style houses and been digitally furnished to represent how the home could be laid out. The final colours / appearance may differ from the images shown both externally & internally. Please speak to our sales agent for more specification information.

Affordability Calculator

Disclaimer

The figures and estimates shown in this calculator should not be relied on as confirmation of affordability and should only be used as an indicative guide to monthly costs. The monthly rental cost is based on 2.75% on the retained equity (subject to change please ask your sales agent). This will usually increase by the annual rate of RPI. The monthly mortgage cost is based on a Variable Rate Mortgage at 4.75% over a 30-year repayment loan. Other costs will apply such as service charge. Sage Homes is not authorised or regulated by the Financial Conduct Authority to provide financial advice. You should always seek advice and recommendations from an independent financial advisor regarding mortgage products, affordability, interest rates, repayment methods and terms and conditions. You should also seek independent legal advice. Your home may be repossessed if you do not keep up payments on a mortgage or any other loan secured against it.